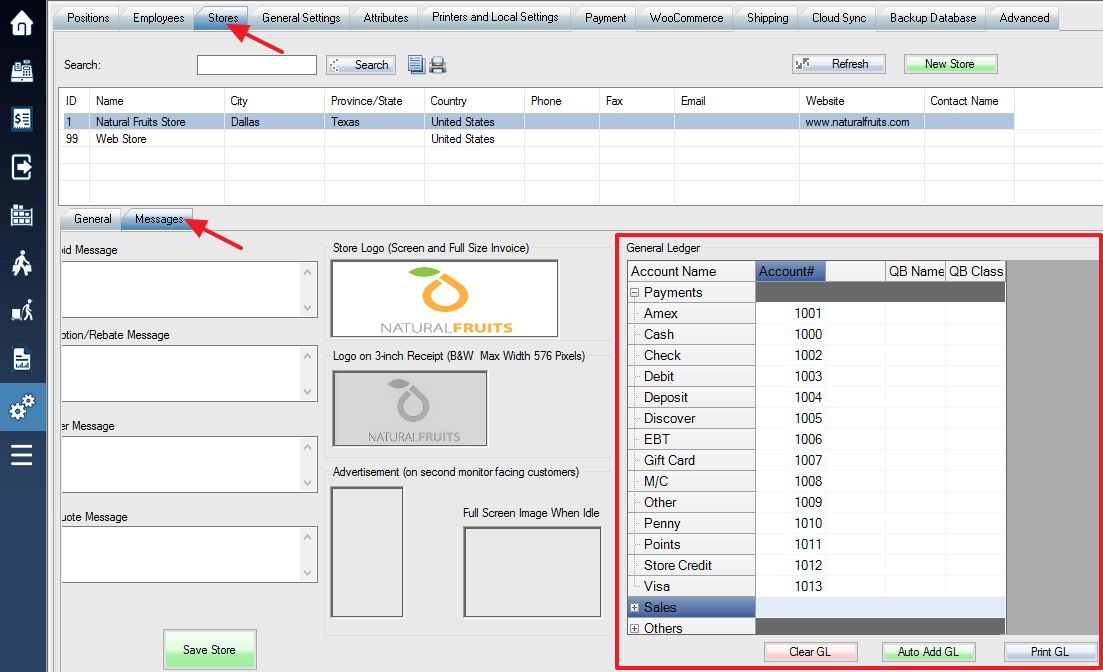

In order to properly export your daily or monthly general ledger for use in your accounting program, you first have to enter your account numbers under general ledger.

Log into the system, and then access the Setup menu. Select Store Settings tab, and then the Message tab in the lower part of the window.

Under the Account Name field in the lower window, you will see a list of every account that your store currently uses. Simply fill in the first empty field (Account Number or Account Name) with the corresponding account from the accounting software you use.

Some entries may have the same account number depending on your accounting setup. Make sure that every account that will be used is assigned a number, although unused accounts can be left blank (credit cards your store does not accept, for example).

Use the Save Store button to save your changes.

***Note*** The Auto Add GL, adds the same General Ledger account numbers to multiple stores. Select the store to copy the accounts to, select the Auto Add GL button, and the numbers from the other store will automatically be added to the selected store.

Each account in your store’s general ledger corresponds to different areas of your transactions, and will always balance positive amounts in one account with negative amounts in another.

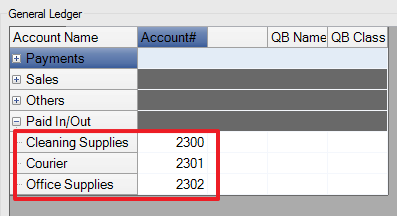

The main general ledger window, with the account section highlighted (your account numbers will most likely be different from the examples).

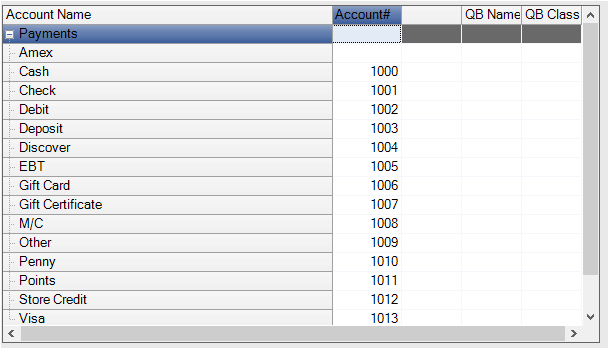

The first section lists all the various payment types you have set up (cash, debit, visa, etc). Payments received are added to the corresponding accounts.

For example, if a customer pays for a sale with 25 dollars in cash, then account number 1000 (Cash) will show an increase of 25 dollars.

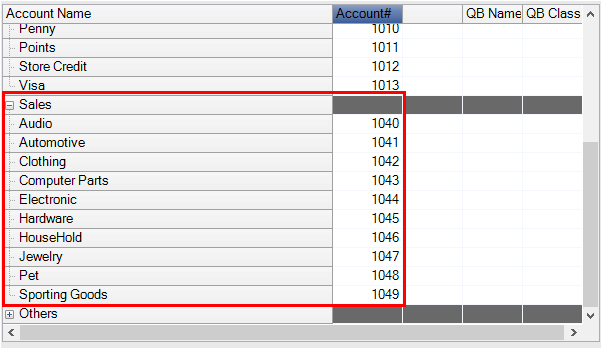

Below the payment types, there will be accounts for each of your store’s departments and sub-departments, listed in blue. Prices of items sold will be subtracted from these accounts. (Note that any time a new department is added in setup (Department Setup) an account number will need to be added to the corresponding account in the ledger.)

If the $25 sale from the previous example was for a grocery item, then the grocery account would show a decrease of 25 dollars.

The next several accounts will always be the same for all stores:

(Layaways) Deposit: Deposits paid for layaways go against a payment account.

AR Payments Received: Payments made to A/R balance are subtracted from this account

Cost Of Goods Sold(+): The cost of all items sold are added to this account

Gift Certificate Payments Received: Payment received for gift cards and certificates is subtracted from this account

Interest (-): A/R interest is subtracted from this account

Interest (+): A/R interest is added to this account

Inventory (-): Cost of goods is subtracted from this account

Markdown (-): The amount subtracted or added to an item due to discount or markup will be shown here. The amount is negative for discounts and positive for markups, and is balanced against the Markdown (+) account.

Markdown (+): The amount subtracted or added to an item due to discount or markup will be shown here. The amount is positive for discounts and negative for markups, and is balanced against the Markdown (-) account.

Over/Short: If end of day totals are over or short the amounts will be added or subtracted from this account

Tax(1,2,3): Tax amounts on sold items are subtracted from these accounts

Tax(1,2,3) (Paid In/Out): Taxes on paid in amounts are subtracted, while tax on paid out is added to this account

Total AR Made: Amounts added to customer A/R from sales are added to this account

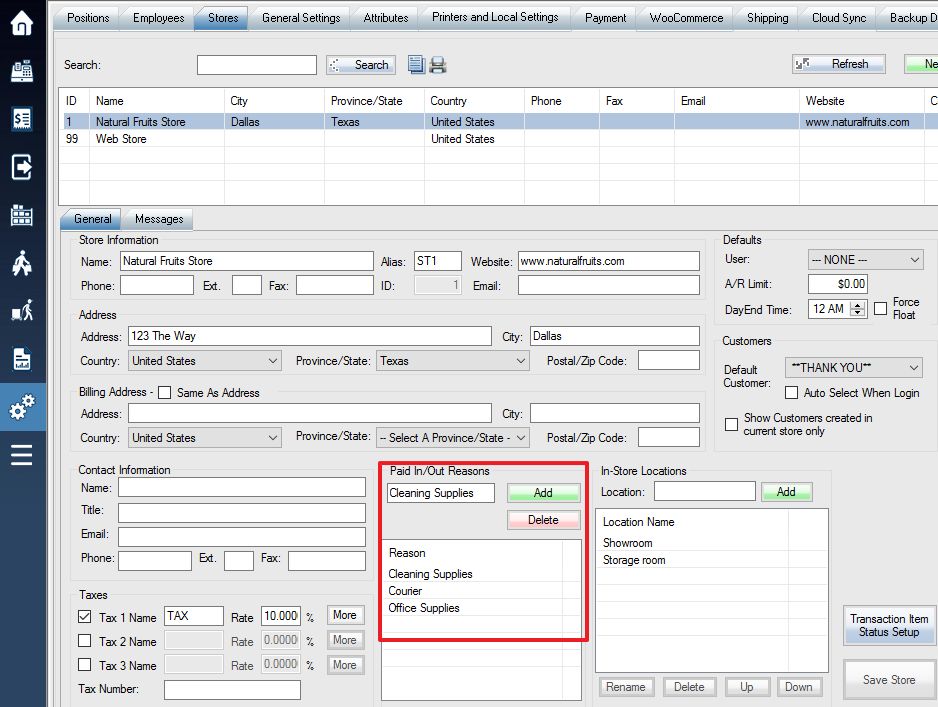

The last accounts listed will be in blue and will correspond to the reasons you have set up for cash paid in and paid out (see: Setting Up Reasons for Paid In and Paid Out), which you can see in the box just to the left of the accounts list. Amounts paid out are added to these accounts, while amounts paid in are subtracted.

If you pay out $15 for cleaning supplies, then account 2350 would have $15 added to it, while the Cash account would have $15 subtracted.

When you create a day end or monthly GL report, all your accounts must balance out.

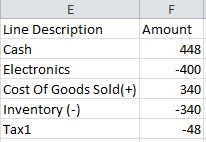

A small sample cut out from a day end report made after a single sale. There is $448 added to Cash (the amount paid by the customer), of which $400 (the price of the item) was subtracted from the Electronics department, and the remaining $48 (the tax on the item) was subtracted from the Tax1 account. The actual cost of the item ($340) was added to Cost of Goods Sold (+), and subtracted from Inventory (-). The accounts are all balanced, so if you were to add the totals you would come up with zero.

The GL accounts are now organized into four main categories (Payments, Sales, Others, and Paid In/Out) which can be expanded or collapsed to display the accounts within each group.